“… in this world nothing can be said to be certain, except death and taxes”

So said Benjamin Franklin at around the time the US Constitution was written. It seems appropriate enough that around the time that same constitution is being tested to within an inch of its life, the current US president seems set on replacing taxes with tariffs.

Appropriate in one sense because, of course, tariffs are just rebranded taxes in any case (who’d have thought it would be a republican president who would enact the most swinging tax increases of the modern era?).

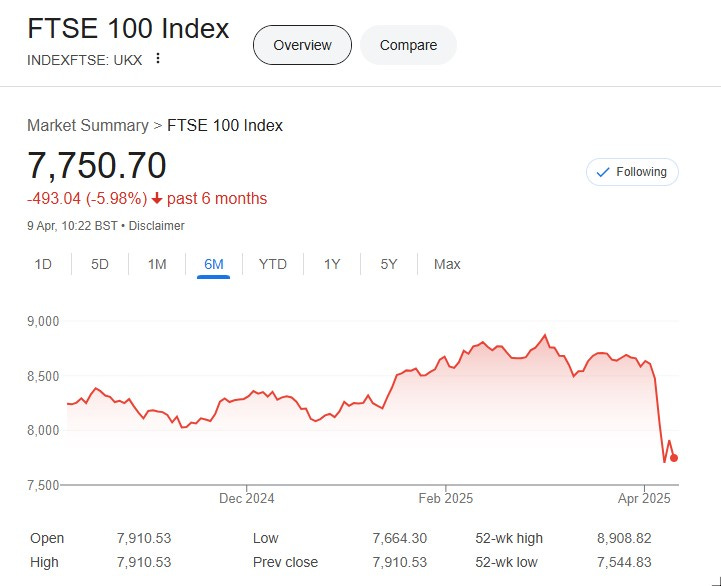

The quote, however, is relevant for those of us running businesses for another reason too. When the largest economy in the free world is hell-bent on changing the rules that have driven the global order for decades, and on doing so in a way that seems capricious and liable to change at any point, very little “can be said to be certain” at all.

Uncertainty is corrosive for business investment, and therefore for productivity growth and the wider economy.

Why? Let’s consider the maths. When you make an investment, you are trading away some money today (the cost of the investment) for (hopefully) a stream of returns which will come your way in the future.

Obviously you hope that the stream of returns is bigger than your initial investment, but there is maths explaining by how much. If you lend someone £100 today for payback in one year’s time, you are depriving yourself of the opportunity to earn interest on that £100 over the year if it sat safely in your bank account. You are also taking a risk, however small, that the money is never repaid. As such, you would expect, just as a bank does, to be repaid a bit more than £100 to compensate you for those sacrifices and risks.

Economists turn that logic into formulae which allow you to work out whether the investment you are making is worth doing or not, but the core ingredients of those models are the same - the basic “safe” rate of interest you would get by just keeping the money in the bank, and the additional ‘risk premium’ you should demand based on how risky the investment looks.

The current wave of tariff madness hits that equation in 2 ways. Firstly, by creating inflation it will increase interest rates, which means that the ‘safe’ rate of return will go up - that raises the bar on investments by making the ‘do nothing’ case more attractive. (Another way of thinking about that is that rising interest rates increase the cost of any debt you need to take on to fund your investment).

Secondly, the unpredictable impact of US policy around the world obviously also increases the riskiness of many investments. If you are building a new factory to expand production, what is the danger that a closed-off US market means there is no demand for what you are making, or that a recession-hit China decides to dump their version of your product into your market at an unsustainably low cost?

Tempting, then, to stick every major project on hold. There is a beguiling logic to ‘wait and see’.

Savvy businesses, though, will remember that risk also presents opportunity. If others in your sector are retrenching or over-cautious, does this represent the moment to steal a march - invest in that new technology that will give you a cost-advantage, or expand into that new market when others fear to do so?

That’s all the more true when you examine the recent historical lesson provided by Covid. Once the worst of the pandemic was deemed over, all the super cautious businesses who had hunkered down during lockdowns decided to go for growth all at the same time, and the result was inflationary chaos as global supply chains clogged up and the price of everything soared. A challenging and uncertain economy might present you the best prices you will ever get for the goods and services you need to expand your business.

It has long been a business cliché that ‘the brave invest when everyone else fears to’ and that businesses who invest against the cycle in recessionary periods do better than their competitors in the long run.

This next period might just provide you with the opportunity to prove that cliché true for your business too.

Loved this simple reminder of the economics today Ian thank you - and hope you are well