Way back in the optimistic heyday of mid-October, we explored in these pages what retailers wanted from the forthcoming budget. My wish-list at the time could be summarised as:

Make sure any tax hikes are on taxes paid out of profits rather than those ‘deadweight’ taxes that hit before you’ve taken a penny in revenue

Sort out the Planning system and get the country building again

Make it easier to hire and train people by, for example, fixing the broken Apprenticeship Levy

Make it easier to raise money and invest in capital projects

Sort out the inequitable Business Rates burden on the High Street

As we sit here now, a month on from that budget, it is easy to raise a cynical smile at this list given that not only did the budget do nothing positive about any of them, it has actually made the business environment harder rather than easier in several of these areas.

Still, we are a tough lot, those of us in consumer businesses (operating on these profit margins, you need a thick skin). So we roll our sleeves up and move on. And so, of course, do our customers.

So what’s the net result of all of the changes the budget did bring, and how will it impact our lives in 2025?

Strangely enough, some early signs of the direction of travel can already be seen in reported economic indicators, even though most of them relate to the trading period immediately before the budget actually happened.

Long time readers will remember that a couple of times this year I have produced an analysis of the ONS retail sales figures:

Those were reported again for the period to the end of October recently, and so I’ve taken the opportunity to dust off my spreadsheet to see what these particular economic chicken-entrails might portend.

These charts, by the way, show the year over year change in volume and value of retail sales with no seasonal adjustment. Unlike much of the reporting which focusses on month to month movement, I prefer to look at these figures the same way you read your own trading stats - based on year over year trends.

Let’s start with Food retailing:

What do we see? A fairly stagnant overall growth performance, with a marked narrowing in the last few months of the gap between the Value and Volume lines. In other words, food price inflation has been dropping and the retailers have been locked in a battle to increase their share of a decidedly sluggish market - as evidenced by the growing gap between winners and losers.

How about in the other half of retailing, Non-Food?

Here we see a decidedly perkier market over the last few months with volume and value looking a lot healthier in the second half of the year than the first. That’s consistent with my post from a couple of months ago about the odd way in which actual consumer behaviour this year has seemed to run in counterpoint to the sentiments expressed by economists.

Evidence of the strong competitive battling going on between retailers is still present in that inflationary analysis, though, with the total sector actually switching from inflation to deflation in the last few months (value rising more slowing than volume).

But hold on. Non-Food is a big category and the overall performance can mask more interesting things going on underneath. Let’s have a look at two more specific categories, both bellwethers of the wider economy.

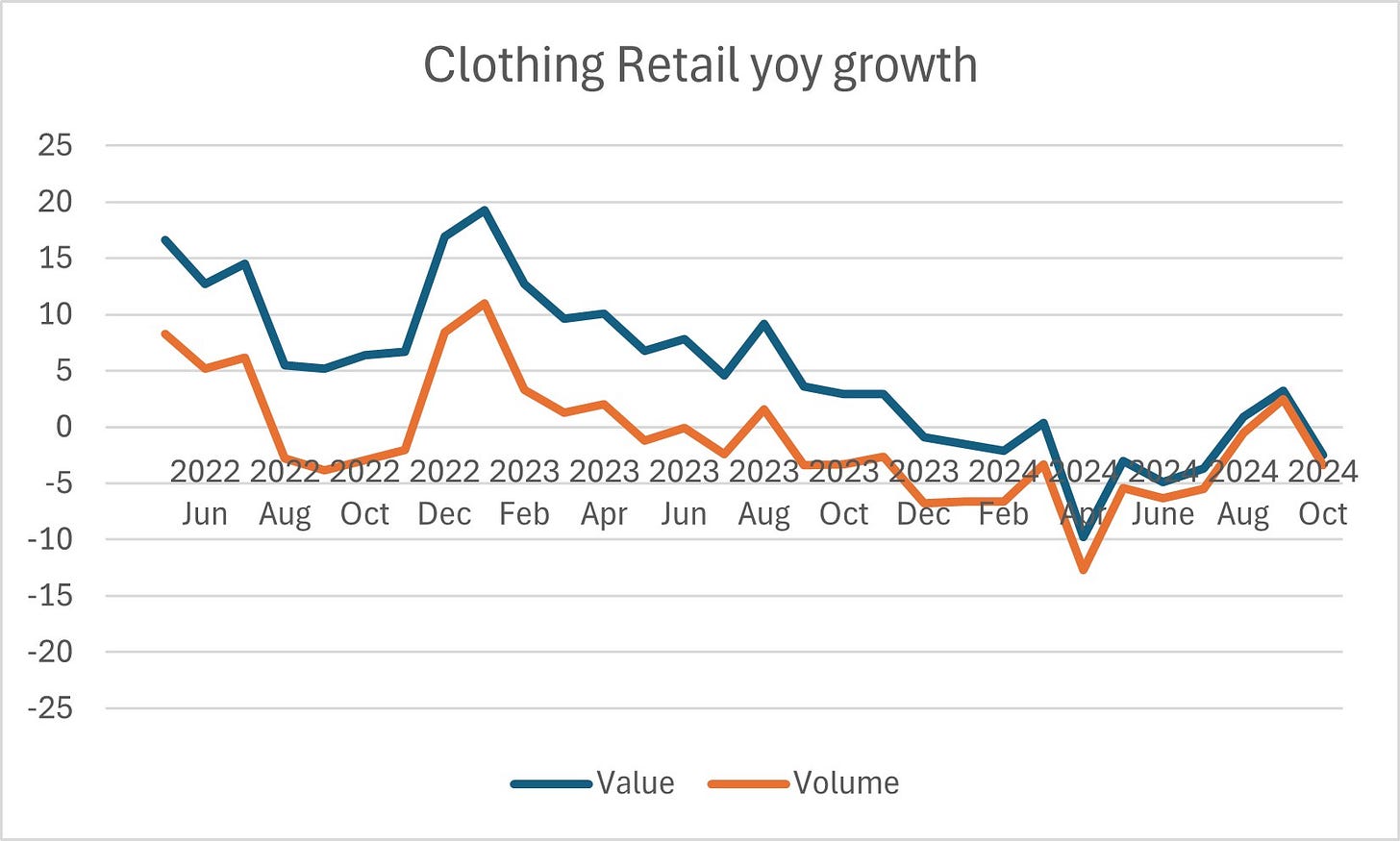

First Clothing:

What do we see here - again some closing of the inflation gap but a more volatile growth story. That isn’t surprising given the seasonal and weather-related volatility that Clothing can see from one year to the next, however, so what about a sector that is perhaps more closely related to consumer sentiment?

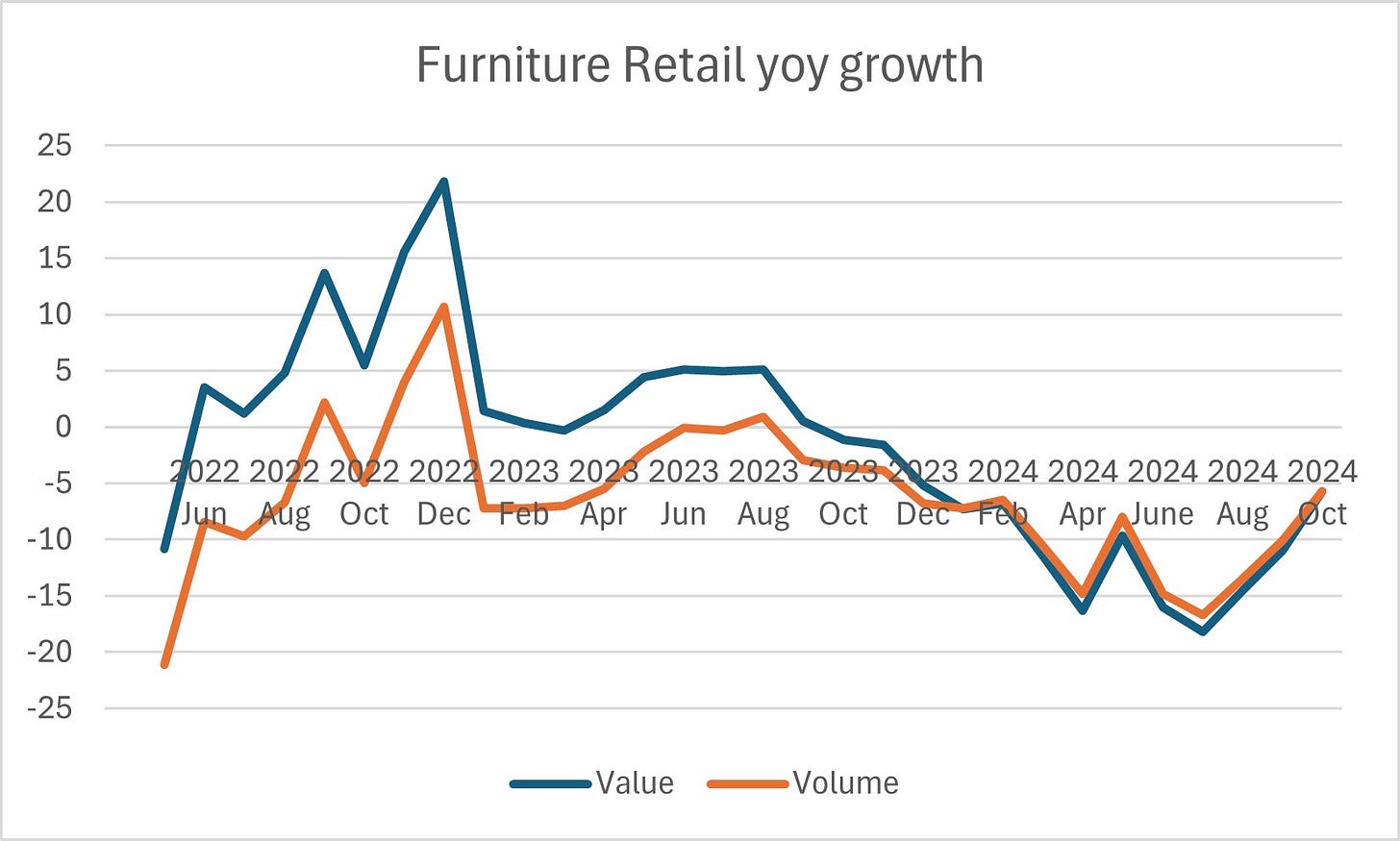

How about Furniture:

Now just hold on a minute, and squint really hard at this one. Again, the bigger picture is of a very weak first half of the year but an improving performance in recent months which is encouraging. But look also at the difference between the lines, which is our inflation indicator. This is a sector which dropped quickly into deflation in the early part of the year, but is that changing? Well, according to the ONS it is - in the most recent reported month, inflation which had been negative for every single month of this calendar year, recovers to be zero.

So does that mean that this part of the retail sector is about to see price inflation again? Does it portend that the wider retail sector might, after a bit of lag, see the same thing?

Well of course not - this is a small move which proves nothing (yet) and these figures are subject to wide revision in later months anyway.

Unless, of course, the trend back to inflation is exacerbated by a massive increase in business costs imposed by central Government!

And there is the rub. Some of the commentary on both the ONS figures and the recently released BRC inflation tracker, which also shows a very slight tightening in the inflation environment, has been “I thought you guys said inflation would return after the budget, but in fact many sectors are still deflating and any worsening of the trend is tiny”.

But that is to miss the point - a better analysis is that we are seeing some small inflationary indicators in these numbers, which predate the budget, and we can also see some very obvious inflationary pressures coming down the track. Remember, the £25bn hit on businesses doesn’t even happen until part way through next year.

And that’s not to mention the prospect of a tariff-based trade war around the world kicked off by the new US administration.

Sometimes forecasting is difficult, but sometimes all the indicators on the dashboard are pointing in the same direction. Buried deep in these ONS stats is the first tiny cloud on the horizon for the Government and the Bank of England - one which I suspect will grow and glower and spread across the sky as we enter 2025. Inflation is coming. Is your business ready?

P.S.

Moving Tribes is kept free for you to read and share thanks to generous support from partners. I’m delighted to be working with the excellent team at Howard Kennedy for this series of posts - they are a full-service legal team with a lot of experience of the kinds of issues consumer businesses often face, so do look them up if you need to.